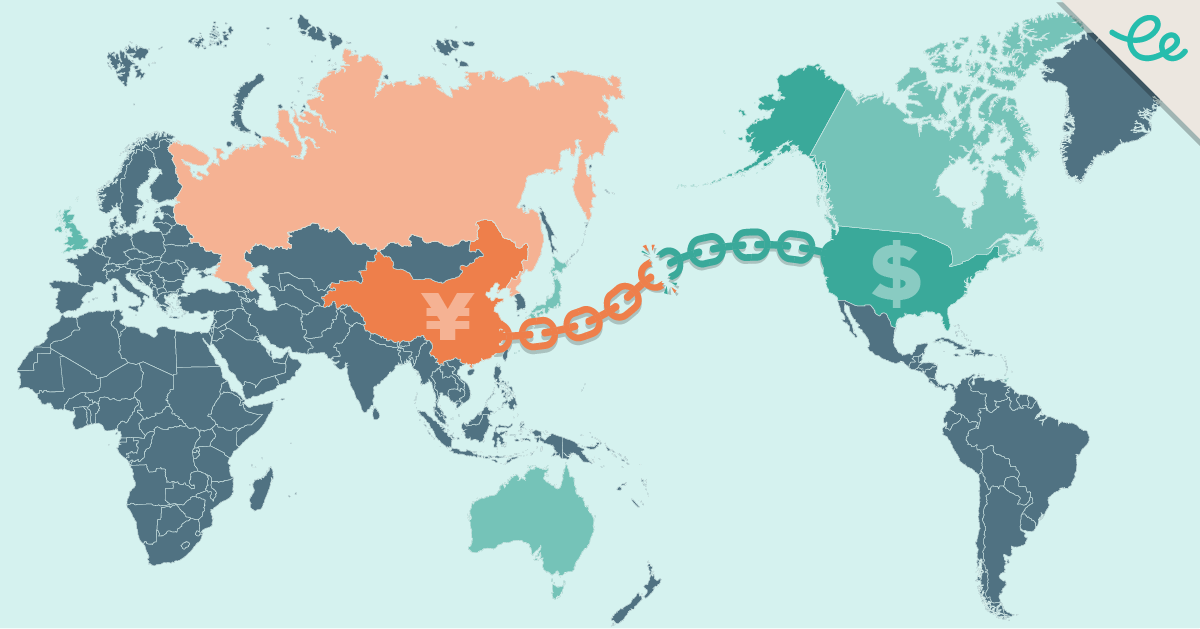

How Beijing Plans to Decouple from the Dollar-Based Global Trading and Financial System

Special Project

Enodo Economics and the Wilson Center have joined forces working on a year-long project to explore how China plans to challenge the dollar-led global financial order, whether its strategy can feasibly allow its decoupling from the dollar and assess its chances of creating a parallel system based on the yuan. The team is led by Diana Choyleva and Dinny McMahon and overseen by our Senior Advisory Board.

We will produce an in-depth report in August 2022, intended to inform US policymakers on the impact this is likely to have on the US and suggest possible responses to safeguard America’s financial system, in line with its expressed national security goals.

We start by developing a detailed understanding of China’s current efforts to promote the international use of the yuan, getting beyond the headlines to understand the mechanics of RMB internationalization. We’ll then build a profile of what Beijing is ultimately trying to achieve, and how a financial system that is trying to decouple from the dollar might operate given China’s self-imposed constraints and the strategic direction of its decoupling efforts. We evaluate what role the e-yuan, China’s digital currency, is likely to play.

Ultimately, we will not be able to say with absolute certainty whether China’s current path will lead to dollar independence. Instead, we intend to outline how far it has progressed and the potential outcomes that we deem most likely over the next five years.

The project is funded by Enodo Economics and a private US foundation.

Senior Advisory Board

Nigel Inkster

Inkster is director of geopolitical and intelligence analysis at Enodo Economics. Prior to that he spent 31 years in the British Secret Intelligence Service, retiring at the end of 2006 as assistant chief and head of operations and intelligence. Between 2007 and 2017 he worked at the International Institute for Strategic Studies, a leading London security and defense think-tank.

In 2020 he authored “The Great Decoupling: China, America and the Struggle for Technological Supremacy”, a book published by Hurst and described by Professor Rory Medcalf as “a timely, sane and compelling account of the techno-strategic contest that will shape the worlds of 2020s and beyond.” In 2016 he authored “China’s Cyber Power,” an IISS Adelphi book published by Routledge.

Mervyn King

Mervyn King (Lord King of Lothbury, KG, GBE, FBA) is a renowned economist who served as governor of the Bank of England (BoE) and chairman of its Monetary Policy Committee from 2003 to 2013. During that time he was also a member of the General Council of the European Central Bank. He was deputy governor of the BoE from 1998 to 2003, chief economist and executive director from 1991 and a non-executive director from 1990 to 1991.

In July 2013 King was appointed a life peer in the House of Lords for contributions to public service. On entering the upper chamber of the UK parliament, he took the name Baron King of Lothbury, a reference to one of the streets flanking the Bank of England. Later in 2013 King was appointed a distinguished visiting professor of business and law at New York University, as well as a distinguished visiting fellow at the Council on Foreign Relations.

He is author of two books, “Radical Uncertainty: Decision-Making Beyond the Numbers”, published in 2020 and co-authored with John Kay, and “The End of Alchemy: Money, Banking, and the Future of the Global Economy”, published in 2017.

Born in 1948, King studied at King’s College, Cambridge and Harvard (as a Kennedy Scholar) and taught at Cambridge and Birmingham Universities before serving as visiting professor at both Harvard University and MIT. He was also a professor of economics at the London School of Economics where he founded the Financial Markets Group.

Andrew Gracie

Gracie has more than three decades of experience in the financial services industry, working mainly at the Bank of England. He was executive director for resolution from December 2013 to December 2018. He had responsibility for the resolution of banks and other financial institutions subject to the UK Special Resolution Regime and for developing the Bank’s policy in this area. As part of his remit, Gracie represented the BoE in a number of international forums, including the Financial Stability Board’s Resolution Steering Group.

Gracie joined the BoE in 1988. In previous roles he worked in departments of the central bank responsible for financial stability, markets and banking supervision.

Martin Anderson

Anderson has more than 20 years of experience in the financial services industry, and currently works as a partner at Oliver Wyman. He served as director general of the Swedish Financial Supervisory Authority (FSA) from 2009 until October 2015, a period in which global capital markets were under severe stress.

At the FSA, Anderson was tasked with supervising the Swedish financial sector. He represented the FSA on the IOSCO Board and on the European Regional Committee, and served as a member of the Group of Governors and Heads of Supervision of the Basel Committee on Banking Supervision, the body where Basel III decision-making and negotiations took place. Anderson implemented a new risk-based supervisory framework that included AML/ATF oversight aimed at cracking down on organized crime and stopping terrorist financing in Sweden.

Fraser Howie

Howie contributes to financial markets analysis at Enodo Economics. He has a rigorous understanding of China’s financial markets, having worked in them as a practitioner and a researcher since the 1990s. The book he co-authored with Carl Walters, “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise,” was named by The Economist as one of its books of the year in 2011.

Howie is co-author of two more books on the Chinese financial system, “Privatizing China: Inside China’s Stock Markets” and “To Get Rich is Glorious!: China’s Stock Market in the ‘80s and ‘90s.”

Comments are closed.